Payment

Service Provider

Payment Service Provider

Online shopping has boomed in the last one decade and especially over the last two years. What used to be an option has now become a mandate; here we are talking about e-commerce. One of the core functionalities of online shopping is transactions. Whenever you shop at a website, you have to make a transaction.

Over time many companies have come up to facilitate the payment procedure online. These companies are known as PSP i.e. Payment Service Providers. Besides ensuring a transaction, they must also ensure 100% security while transferring data as well as storing information collected.

What is a PSP?

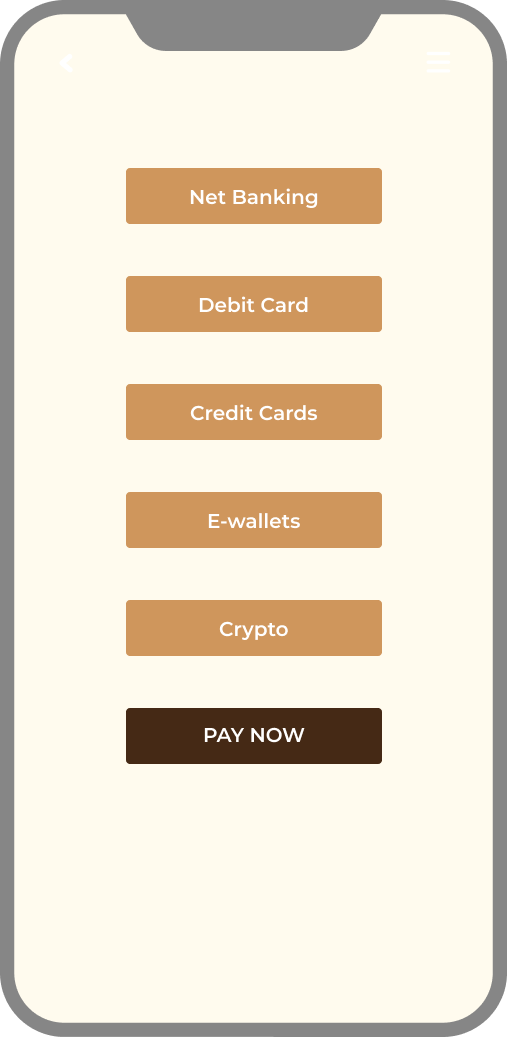

A Payment Service Providers are organisations that offer a consolidated package of different types of payment options available for us. Some of the payment options available to us include net banking, debit cards, credit cards, e-wallets, etc. Handling each and every financial institution individually is expensive, raises more security woes and labour cost. A PSP brings everything under one roof, thus making it easy to navigate as well as more secure.

Perks Of Using A PSP

To sum up, here are the benefits of having a PSP for your business:

One stop solution for numerous transaction use

Accept multiple currencies

Simple, Seamless, Secured

One stop solution for numerous transaction use

Accept multiple currencies

Simple, Seamless, Secured

Secured

Secured

Add new payment methods easily

Prevent fraud from customer’s end

Gold Tech International has a number of digital projects under its wing and we wish to be an active user of PSPs. Whether it is ecommerce, gold investment through wealth management, or bullion trading, a reliable PSP will form the backbone of our business model.